Introduction

Oil prices have continued to fall this year, with a barrel of West Texas crude dropping below 50 dollars in early January. Some of the market analysis has been close to guesswork, given the uncertainty over the trends and direction of oil prices in the short and medium term. Forecasts differ on the average oil price for the rest of 2015. Some believe it will rise, especially in the second half of the year, a view held by the Organization of Petroleum Exporting Countries (OPEC) based on signs of an improving global economy. Others expect it to fall even lower; for example, the United States Energy Information Administration (EIA) predicts that despite a likely improvement in global economic performance, a glut in oil supply will lead to price depression.

To what extent are oil prices affected by the equation between supply (production) and demand (consumption)? Is that the sole factor affecting the price? While playing a part, there are often other factors that have a stronger effect on the oil price than the gap between supply and demand.

Factors Affecting the Price of Oil

Among the factors affecting the price of oil are those that can be termed behavioral-psychological with regards to the decisions of producers, consumers, and speculators. Producers may sometimes continue to maintain production and boost supply even though prices are low, in order to preserve market share in the face of market competitors. This was confirmed by some OPEC ministers and its secretary-general when they justified the decision taken at the last OPEC meeting in November 2014 to maintain the daily production ceiling of 30 million barrels. Equally, some producers might decide to lower the price of their oil in comparison with their competitors even when supply is plentiful on the world market, in order to maintain their grip over certain markets. This price war intensifies when there is a glut in supply and prices are low, and cools down when supplies are low and prices high.

For consumers (purchasers) of oil, their decisions to buy are influenced by the current price and their expectations of the future price. If prices remain low for a specific period, buyers will reduce the quantities they acquire at the spot price and completely stop forward purchasing in the expectation that prices will drop further. This means that the overall level of global demand for oil will fall, which itself will lead to downward pressure on prices, irrespective of the size of global supply. The opposite applies when there is a belief or expectation that prices will rise. Then consumers will rush to buy more (spot or future contracts), taking into account the expected price rise and its effect on the cost of obtaining oil.

The behavior of traders and investors in the financial markets is akin to that of consumers: they take decisions to buy and sell spot or future options in oil with the aim of maximizing profits arising from the differential between the sale and purchase price. When market players see their investments in oil options at risk from a prolonged period of low prices, they will decide to sell up to avoid (further) losses. This increases downward pressure on oil prices in world markets. Conversely, rushing to buy oil-related assets in the expectation that prices will rise creates upward pressure on prices.

Geopolitical factors influence the price of oil through their effect on global production and supply. Natural disasters, conflicts and political instability in locations where oil is produced, distributed, transported or consumed all have an effect. In addition, oil is sometimes used as a means to achieve political goals, even if not stated explicitly. For example, an oil-producing state with influence might shift prices up or down in order to apply economic pressures on another government/s with whom there is a significant policy disagreement or conflict. The oil price, therefore, is the outcome of a complex nexus of factors which interact with each other to different degrees at any given moment.

Current Features of the Oil Market

World oil supplies have increased significantly over the last few years as a result of increased production by non-OPEC states. According to EIA data, average global production rose from 84.5 to 90.16 million barrels a day from 2009 to 2013. Most of this 6.6 percent increase was the result of the growth in shale oil production in the United States. While demand increased by 6.8 percent from 84.7 to 90.48 million barrels a day over the same period, the average price of a barrel of West Texas crude rose from 62 to 98 dollars, a 58 percent increase. Thus supply and demand rose by a similar percentage during the same period that the price rose by more than half.[1]

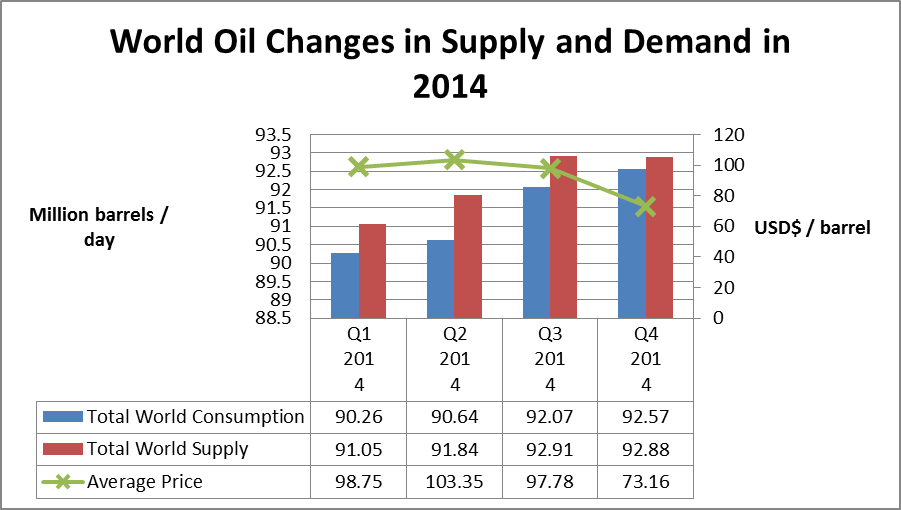

In 2014, average global production stood at 92.18 million barrels a day and average consumption was 91.39 million barrels a day, meaning a net surplus over the year equivalent to 790,000 barrels a day. Nevertheless, the average price (of West Texas crude) for the same year reached 93.62 dollars a barrel (according to the EIA). The main reason for the fall in the average price in 2014 compared to the levels in 2012 and 2013 was the low prices recorded in Q4 2014, when the price reached 73.16 dollars a barrel, compared with 97.78 dollars a barrel in Q3 of that year.

Remarkably, when surplus production reached its peak in Q2 2014 (1.2 million barrels a day on average), the oil price peaked too (103.35 dollars a barrel), even though the increase in demand compared to Q1 was limited (see Figure 1). When surplus production fell back in Q4 2014 to 310,000 barrels a day, due to a fall in global production and an ongoing rise in demand, prices fell back to 73.16 dollars a barrel. Economists agree that an increase in demand for a commodity in a situation of fixed or falling supply will result in a price rise, which is exactly the opposite of what happened in Q4 2014.

Source: US Energy Information Administration[2]

It seems clear, therefore, that the changes in the oil price during 2014 were not determined by the relation between supply and demand on the world market. In the first three quarters of the year, when supply exceeded demand, the price of oil was very high, while in Q4 2014, even though the size of the surplus diminished and demand grew, prices dropped by 25 percent in comparison with Q3. This suggests that behavioral-psychological factors played the lead role in setting oil-price trends in 2014. Speculation on the market undoubtedly played an important role in high prices, especially in Q4 2014, as attested to recently by the general-secretary of OPEC, Abdallah el-Badri, and Saudi Oil Minister Ali al-Naimi. This indicates that the price of oil on the world market before its collapse at the end of 2014 was artificial, and largely due to global speculative activity unreflective of the link between supply and demand.

In parallel with speculation, mostly carried out by investors on the financial markets and brokers on the global oil market, forecasts of price trends (particularly by consumers) played a role in price volatility during 2014. Although the oil price peaked in Q2 2014 as a result of speculation, demand grew strongly in Q3 (see Fig. 1). This may have been down to consumer expectations of future rises in the oil price, which prompted them to increase orders. On the other hand, once prices began to fall at the beginning of Q4 2014, it seems that some consumers started to anticipate a continued price slide. This expectation was reinforced by increased production outside of OPEC and OPEC’s decision in November 2014 to fix the daily production ceiling at 30 million barrels. These two factors reduced demand because there was an expectation that oil would be available at a lower price in the future. This may explain the limited increase in demand in Q4 2014 compared to Q3, which saw a leap in demand for oil.

There are those who believe that the recent OPEC decision was shaped by political reasons, using the preservation of market share as a pretext. According to these analysts, some Gulf oil states and Saudi Arabia in particular, perhaps even in coordination with Washington, are looking to punish Iran for its regional policies, especially vis-à-vis Syria, and to exert pressure in relation to nuclear talks. Russia may also be a target on account of its positions regarding the Ukraine crisis, Middle East issues, and its use of energy supplies to European states as a tool for political blackmail.

These views are exaggerated. Some are more like conspiracy theories; a last resort for explaining political and economic variables in the international arena that seem to defy rational explanation. Proponents of such an analysis overlook the fact that all the active players in the oil market are negatively affected by depressed prices, and the longer and the more prices remain low, the worse the impact on all of them. The effect does vary, however, depending on the extent to which each one is dependent on oil revenues for GDP, as well as on the levels of reserves each can fall back on in order to meet the income shortfall arising from low oil prices.

At the beginning of 2015, oil prices continued to fall, dropping below 50 dollars a barrel. Meanwhile, there are disagreements between OPEC states over the correctness of the decision to maintain the production ceiling, as well as signs of an undeclared price war between them, with reports of reductions in the price of oil deliveries for February 2015 to certain world markets (as Saudi Arabia and Iraq have recently done).

Expectations of increased production by non-OPEC states are helping to keep downward pressure on prices. According to the EIA, average U.S. oil production for 2015 and 2016 is expected to be 9.31 and 9.53 million barrels a day respectively, and average production for non-OPEC countries is expected to be 56.84 and 57.37 million barrels a day for the same years. The EIA also predicts that the average price of West Texas crude will be 54.58 dollars in 2015 and 71 dollars in 2016, with Brent crude 57.58 and 75 dollars respectively.

EIA’s forecasts match those of other institutions such as the IMF and investment bank Goldman Sachs in predicting a noticeable fall in oil prices in 2015 compared with 2014. However, OPEC remains optimistic about price improvements during 2015, encouraged by improving global demand and economic performance in general, and in emerging economies like India and China in particular. Hence OPEC’s decision to maintain production levels.

Conclusion

It is hard to predict the course of oil prices over 2015 because of the interaction between the set of factors discussed above. Nevertheless, it is most likely that the price of oil will stabilize at a higher level following the depressed levels expected for Q1 2015; especially as low prices have started to hurt many shale oil producers in the United States who are pushing for a withdrawal from the market. Finally, the OPEC states cannot be blamed for causing the recent price collapse, because these countries can control their own levels of production but not those of non-members. The key OPEC states are fearful that if production falls, non-OPEC states will fill the gap and with no guarantee of any significant rise in price.

To download and read this Assessment Report as a PDF, please click here. This Report was translated by the ACRPS Translation and English editing team. To read the original Arabic version, which appeared online on February 3, 2015, please click here.

[1] For the facts, figures, and data included in this report and further information see the database of the Short-Term Energy Outlook. Market Prices and Uncertainty Report, Short-Term Energy Outlook, U.S. Energy Information Administration, January 13, 2015, http://www.eia.gov/forecasts/steo/uncertainty/index.cfm.

[2] Database of the Short-Term Energy Outlook, January 13, 2015, http://www.eia.doe.gov/steo/cf_query/index.cfm.